The Chancellor of the Exchequer has announced the introduction of the Help to Buy ISA from autumn 2015. If you are a first time buyer looking for Help to Buy ISA advice, we are happy to help. We serve clients across East Sussex, including Eastbourne, Uckfield, Lewes, Crowborough, Hastings, Seaford and Newhaven. (Recommendations have led to clients living well beyond Sussex too.)

Help to Buy Scheme

The government is committed to supporting people who aspire to become homeowners. Recognising that increased deposit requirements had left many hardworking households unable to get onto the housing ladder, the government took decisive action by introducing the Help to Buy scheme in 2013.

The two elements of a Help to Buy scheme have so far supported 83,000 people realise their dream of home ownership. Despite the high loan to value mortgage market working well due to the success of Help to Buy, many first time buyers are still struggling to save enough to put down a deposit for their first home.

The government recognises that many people are working hard and saving hard to get onto the housing ladder. The Chancellor of the Exchequer announced recently the introduction of the Help to Buy ISA.

What is the Help to Buy ISA?

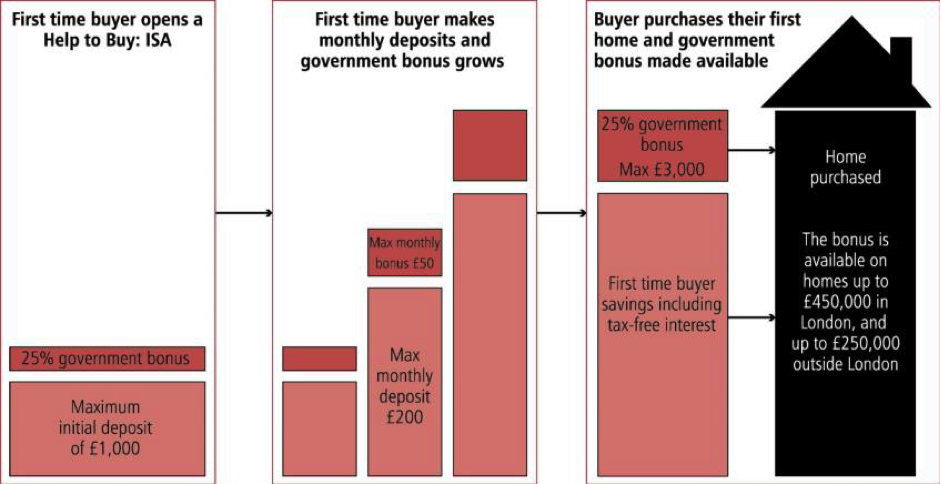

The Help to Buy ISA is designed to reward people that are saving up for their first home. First time buyers that choose to save through a Help to Buy ISA will receive a government bonus to help them make the critical first step on the housing ladder.

The bonus will represent 25% of the amount saved so, for the maximum monthly saving of £200, the government will contribute £50, with a maximum government contribution of £3,000 on £12,000 of savings.

The bonus will be calculated and paid when you buy your first home.

For basic rate taxpayers, this will be equivalent to saving completely free of tax for their first home. Accounts are limited to one per person rather than one per home so those buying together can both receive a bonus.

How a Help to Buy ISA works…

Source HM Treasury

The government bonus will be capped at a total of £3,000 on £12,000 of savings.

First time buyers will then receive the government bonus at the point they are ready to buy their first home. It can be put toward homes that are worth a maximum of £450,000 in London and £250,000 in all other areas of the UK.

Savers will be able to open a Help to Buy ISA for a 4-year period after the date the scheme formally opens. Once an account is opened there is no limit on how long a person can save into a Help to Buy: ISA and no time limit on when they can use their government bonus.

The government intends the Help to Buy ISA scheme to be available from autumn 2015. Allowing a £1,000 initial deposit means that people who are saving between Budget Day and the autumn will have the opportunity to benefit from the government bonus on those savings.

Clifford Osborne are not tied to any financial institution and therefore offer you truly independent advice. A free, initial no obligation review meeting can take place at our offices in Eastbourne East Sussex, at your workplace or in the comfort of your home.

For more information about the Help to Buy ISA and to arrange a no-obligation initial review, please do get in touch. Find out about Clifford Osborne’s full range of independent financial advice services.