£700M – EQUITY RELEASE HITS ALL-TIME HIGH FOR SINGLE QUARTER

- Value of quarterly lending in Q2 2017 rises by over a third year-on- year, as housing wealth continues to play a more prominent role in financial planning for retirement

- 8,454 new plans were agreed in Q2 2017, up by 27% on Q2 2016

- In total, the sector recorded activity from over 16,000 new or returning customers between April and June

- Drawdown plans remain the most popular product choice, accounting for 68% of all products

taken out

The equity release sector experienced another record quarter between April and June, with the number of new customers and total value of lending rising significantly year-on- year according to the latest quarterly figures from the Equity Release Council.

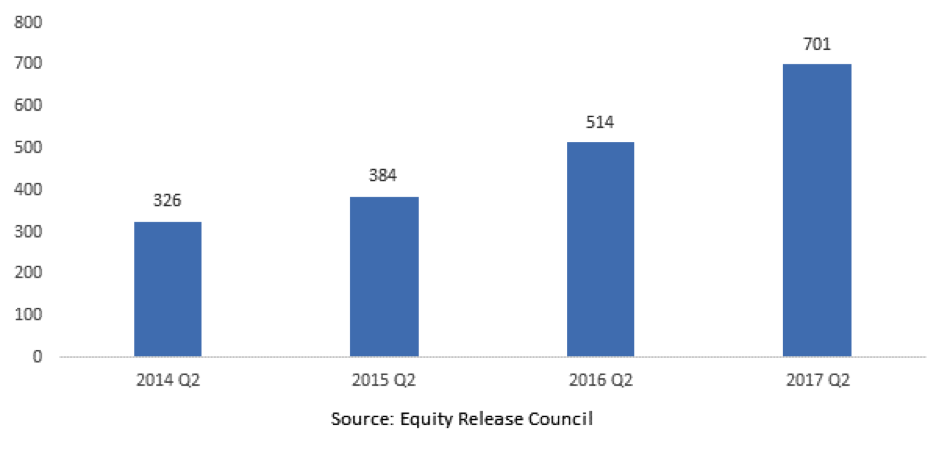

Over the course of Q2 2017, over-55s withdrew a total of £701 million from their homes: the highest figure in any single quarter since The Council started recording quarterly activity in 2002. It represents an increase of over a third (36%) in the value of lending when compared to Q2 2016.

Continued growth means that second quarter lending activity has now risen 82% in the last two years, from £384 million in Q2 2015.

The Q2 2017 total amounts to almost 90% of the activity recorded during the whole of 2011 (£789m) in the wake of the financial crisis, since when, housing wealth has become steadily more established as an option for retirement planning.

CUSTOMER NUMBERS

Council members supported more than 16,000 equity release customers between April and June this year. Of these, over half (8,454) took out new equity release plans: 27% higher than the 6,671 new plans recorded in Q2 2016.

Q2 2017 also saw 6,566 returning drawdown customers, up 9% from the previous quarter. Drawdown products allow customers to release multiple sums from the value of their home in instalments, therefore reducing the build-up of interest over the duration of the plan. The remaining 1,002 customers in Q2 agreed further advances (extensions) on existing plans.

Graph 1: Value of equity release lending per Q2, Q2 2014 to Q2 2017 (£m)

DRAWDOWN LIFETIME MORTGAGES REMAIN CONSUMERS’ PREFERENCE

In terms of product choices, drawdown lifetime mortgages remained the most popular product in the market in Q2 2017. Almost seven in ten (68%) new customers opted for drawdown in the quarter, up from 67% in Q2 2016 and 65% in Q2 2015. Drawdown also made up 63% of total Q2 lending activity in terms of value, up from 59% a year earlier.

Lump sum products meanwhile accounted for 32% of new plans agreed and 37% of total lending in the second quarter. The value of lump sum lending increased by 25% over the last 12 months from £209 million in Q2 2016 to £262 million in Q2 2017. In comparison, drawdown lending rose 44% year-on- year from £304 million to £438 million.

The figures demonstrate that older customers are increasingly looking towards the wealth in their homes – often their most valuable asset – to help fund their retirement. Recent findings from The Council’s April 2017 white paper, Equity release rebooted: the future of housing equity as retirement income, indicated that total homeowner equity in England reached £2.6 trillion in 2016, of which £1.8 trillion belonged to households with a homeowner aged 55 years old or over.

Nigel Waterson, Chairman of the Equity Release Council, commented:

“Continued rapid growth in housing wealth withdrawals reflects an increasing appetite among older consumers to utilise bricks and mortar for funding retirements.

“The retirement income pressures facing many savers in the era of defined contribution pensions and low interest rates are encouraging homeowners to consider a wider range of financial options. Housing wealth – often people’s most valuable asset – is an important part of bridging the gap between the comfortable retirement people want and the retirement they can afford from their savings.

“It is vital we build on recent work by regulator and industry to encourage more joined-up thinking between related areas of financial services, so that consumers have the best support for their transition into later life.”

For further information, please contact our financial advisers. See our other blogs for more Equity Release News.

Clifford Osborne offer independent mortgage and equity release advice in Eastbourne, Tunbridge Wells, Brighton, Lewes, Uckfield, Hastings, Bexhill, Seaford, Newhaven and further afield. Please contact us for more information or to book your free initial review.