It’s often said that retirement can seem as big a challenge as starting your first job. To enjoy a comfortable old age means doing some in-depth thinking well in advance, asking yourself what your goals are and how much money you want to have at your disposal when the time comes. So how do you approach pension planning and how should you create a robust financial plan?

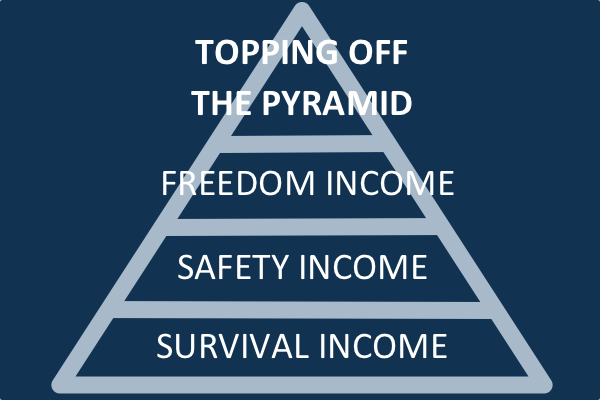

A NEW SLANT ON MASLOW’S PYRAMID

Many people find it helpful to think in terms of Abraham Maslow’s famous Hierarchy of Needs. His pyramid diagram contained various levels of need that human motivations generally move through, starting with the physical requirements for human survival, and ending with mankind’s highest aspirations. Adapting this approach to personal finance was pioneered by US money guru, Mitch Anthony.

Using this hierarchical approach in a personal finance context can be a useful aid in deciding how to plan your income in retirement.

> SURVIVAL INCOME

This is the base of the pyramid and consists of the income you need to pay all your basic household expenses. In effect, it means drawing up a budget that covers all your likely regular bills and running costs.

> SAFETY INCOME

The next layer up, this is the amount you might need to meet life’s unexpected events. Typically, this would include health and later-life care costs, loss of income and any emergency financial help you might want to give your family.

> FREEDOM INCOME

This layer is all about assessing the likely cost of doing and enjoying all those things that you never had time to do before you retired. So if you’re planning a trip, a major purchase or want to indulge yourself in other ways, this is the amount you feel you’ll need.

> TOPPING OFF THE PYRAMID

Many people add a gift layer representing money they want to pass onto children and grandchildren during their lifetime, and some add a dream layer, their ultimate ‘bucket list’, to the very top. By viewing your finances in this way, you can gain a clear picture of how much you need to have saved by the time you reach retirement.

With these amounts in mind, you can build up a comprehensive plan to help ensure that you can enjoy the sort of retirement you’ve always wanted.

Clifford Osborne are Independent Financial Advisors (IFA) based in Eastbourne, East Sussex, offering pension planning advice, mortgage advice and more. You can read our VoucherFor reviews here. Our clients often come from Uckfield, Lewes, Brighton, Tunbridge Wells, Hastings, Bexhill, Newhaven, Seaford, Crowborough and further afield.